The concept of taxes freaks me out! I know how to pay the sales tax on everyday purchases, but I’m also aware that when you make enough income there’s even more paperwork to be done. That time of year, I see my parents sitting at the dining table and it’s covered in papers. Can you explain what that process is?

Annual income tax filings can definitely look intimidating to do. Lots of forms. Tons of papers. All the receipts! And a deadline of April 15th. But taxes are not that scary when you’re starting out.

The good news is that, if you’re working as an employee, you’ve likely already paid your taxes during the course of the year. Look at your pay stub. You will see information about your “Gross Pay” and then deductions from that amount for various taxes and other things. The end result is your “Net Pay,” which is the amount that you see in your check.

What you see your parents doing at the beginning of the year is the federal and state income tax. This process is like a true-up to see if the amount you have contributed from your paychecks throughout the year is right based on a number of possible things that can impact it.

If you’re just starting out, your tax return will likely be much simpler than his AND you may get money back from the government. You’re probably not at the dining-table-full-of-papers stage yet.

There are a couple of big topics when it comes to taxes: Income and Deductions.

Taxes on Income

Income can come from multiple sources and all of it needs to be reported. You only have to file if you have make above a certain amount. That amount adjusts each year from the IRS. Check out the current amount here: https://www.irs.gov/publications/p17/ch01.html

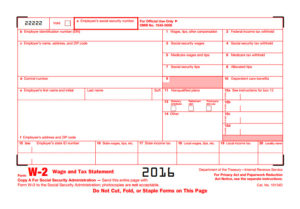

The most common form of income is from employment. Employers (W-2 style) take taxes out of employees’ paychecks automatically. They remove an amount estimated based on your income, how often you are paid, and the number of “exemptions” you claimed when filling out your W-4 form.

The most common form of income is from employment. Employers (W-2 style) take taxes out of employees’ paychecks automatically. They remove an amount estimated based on your income, how often you are paid, and the number of “exemptions” you claimed when filling out your W-4 form.

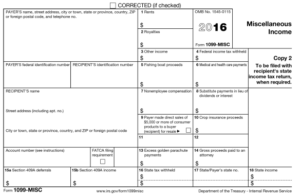

Some other common types of income are unemployment, contract work (like on a 1099), dividends or capital gains, interest payments, and so forth. You even report barter exchanges have if they can be quantified monetarily. This will usually adjust the amount you would need to pay in taxes up.

Some other common types of income are unemployment, contract work (like on a 1099), dividends or capital gains, interest payments, and so forth. You even report barter exchanges have if they can be quantified monetarily. This will usually adjust the amount you would need to pay in taxes up.

Employers must mail you physical copies of these forms by January 31st for the prior year.

Deductions to Taxes

On the other side, you have deductions. These are things that generally adjust the amount you would have owed in taxes down. Common things you might encounter as deductions are:

- Student loan interest

- Tuition and fees for education

- Interest paid on mortgages

- Any profit or loss from a business you own

- Credits for dependents (like kids or other family members for whose financial support you are solely responsible)

- Home improvement credits

There are a ton more. For now, focus on the ones that apply to you.

Income Tax Filing Forms

Depending on which of the types of income and deductions apply to you, you choose between the three federal income tax filing forms: 1040EZ, 1040A, and 1040. I’ll review each of them briefly below and you can get full details on the IRS site here: https://www.irs.gov/taxtopics/tc352.html

The 1040EZ Form

The 1040EZ is the simplest (and probably the one you can use when you’re just starting out). Use this form if you have earned money only from jobs held with a company you don’t own, made under $100,000, and want to take the”standard deduction.” The standard deduction is a flat amount that does not consider your personal situation. Unless you have extenuating circumstances, you can probably use this to do your filing. It is the simplest way.

The 1040A Form

The 1040A is a little more complex. This one may be a good choice if you have some additional types of income (like capital gains from investments) that the 1040EZ does not allow. As with the 1040EZ, you cannot itemize deductions with the 1040A. You can only take the standard deduction amount.

The 1040 Form

If you make more than $100,000, need to itemize deductions, or need to file additional schedules, then you have to use the 1040. You go through a lot of receipts and forms that are sent by banks and such in order to fill in the appropriate schedules for itemizing. For instance, things like owning a home or business or having a lot of investment transactions are reasons to itemize deductions. This is probably what your parents have to file.

How to File

Tax filings are due April 15th… ish. This date varies based on whether the 15th falls on a weekend. If you believe that you will miss the deadline, you must file an extension by April 15th (or whatever day the due date is for the year). An extension gives you more time to get your taxes together for filing.

You can file by mail or online. If you want to file online, you will need to get an Electronic Filing PIN. Your tax preparation website can help with this. You can also find the info on how to get this for yourself on the IRS’ site here: https://www.irs.gov/individuals/electronic-filing-pin-request

Many sites help you prepare your taxes for free. For instance, Credit Karma’s new tax service is free no matter which form you file. On the other hand, TurboTax costs money if you file the standard 1040. But they offer great advice as you complete each section.

So don’t be too scared. You’re probably in a place where you can use the simplest form and won’t have a lot of crazy things to deduct (or papers all over the table). If you’re still nervous or have questions, please leave comments below.

Note: I am not a professional accountant or tax preparer. If you have questions about your specific situation, consult with a tax professional or tax preparation website.